Seller Financing Online Business Acquisitions – A Great Plan or a Devious Trap?

If you’ve ever bought or sold a “bricks and mortar” business, odds are that there was a seller financing component involved.

To the uninitiated, seller financing essentially means that instead of paying the whole purchase price upfront, you’ll have the seller carry a “note” (essentially, a loan) that you’ll pay out over a set period.

There are many shapes these deals can take. The % of the purchase that’s seller-financed can be anywhere from very little to the whole way. The term of the note can range from a few months to a decade. The payments can be made in monthly installments or as a single balloon payment.

But all of this is outside of the scope of this article. We’re here to talk about seller financing in online acquisitions in general.

Online is Not The Same As Offline

Those “transitioning” from the offline world often assume that what holds there also works when buying online businesses. In many ways, this isn’t so, and seller financing is one of the areas where things are very different.

In short: seller-financed deals are far less common when buying an online business than they are when purchasing a gas station or a grocery store. And even when you do encounter a seller financing component, the % of the purchase price that it makes is usually much smaller. The typical term is also much shorter.

That’s because of 3 main reasons.

Supply & Demand: Many Buyers; Few Good Businesses

As with any industry, it’s predominantly the supply & demand ratio that sets whether deal conditions tend to favor the seller or the buyer. As it happens, the market for online businesses has, for the better part of the last decade at least, been heavily dominated by buyers.

People who have a few hundred thousand to a couple of million to spend on a quality online business seem to be everywhere, while the quality businesses that they’re looking to buy are few and far between.

That’s created a dynamic where, not only are the valuation multiples on the rise (but not enough so to make the acquisitions unattractive), but it’s usually the sellers who get to dictate deal terms.

In the offline world, a gas station may get one interested buyer over 6 months. With an ecommerce business, on the other hand, it’s not unusual to have 5-10 buyer calls over the first week of the listing launch.

Fewer Moving Parts

It should come as no surprise that seller financing is primarily something that helps the buyer manage their cash flow. But in addition to this, it also helps keep the seller motivated to assist the business and the buyer going forward, rather than leaving them high and dry or (worse), going out to compete with them.

That can be very valuable when it comes to businesses that have many moving parts or ones that rely on the owner’s specialized know-how. The same is true in cases where there’s an extended transition period involved.

While not so all of the time, the above tends to apply far more often to offline businesses than it does to online ones, especially in the sub-$1MM range. Most online businesses in this price bracket tend to be fairly straightforward, making the prospect of seller financing less justified than it would be when buying, say, a bakery where the previous owner is also the pastry chef.

Seller’s Motivations

Perhaps most importantly of all, whether a seller is more or less likely to go with seller financing comes down to what they’re looking to get out of the sale. That’s another area where online and offline tend to differ a lot.

With the average online business, the seller is looking for one of two things – cash or freedom.

Most sellers either want the cash to invest it elsewhere, while the freedom they desire comes from burnout or complacency. In the offline world, reasons for selling are more colorful – from needing to move to a different location to finding it hard to compete in the area. Even retirement or getting too old to run the day-to-day are common reasons, especially with smaller businesses.

As you can see, the reasons for selling tend to be more “real” and “immediate” with offline businesses, allowing more room for creative deal structures like seller financing and earn-outs. There’s also less need for an immediate cash payout.

Put it this way – the owner of a corner shop who’s ready to retire may not care the slightest whether he gets paid today or in 3 years and may even prefer to be paid over time if it means earning interest. What he wants, though, is to get out and be done with it, and he’d much rather take a slightly worse deal that’s on the table today and risk waiting another year for a better deal to come along.

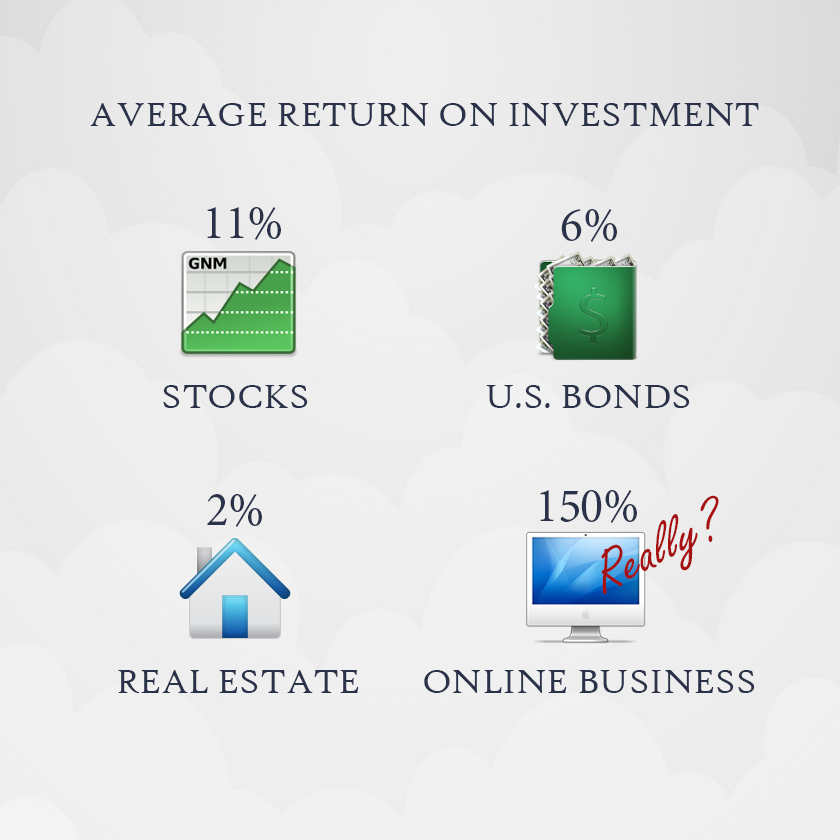

Someone who owns a couple of ecommerce businesses, on the other hand, usually couldn’t care less whether they have the business for another few months or not. Therefore, any deal that doesn’t see them cashing out a significant sum of money wouldn’t make sense as they may as well hold on to the business and make the same amount of money from the business itself.

This dynamic is the primary reason why seller financing is so much less common in online acquisitions.

But It’s Still Good to Try, Right?

Many buyers approach this whole topic with the mindset of “what’s the worst that can happen” and tend to still write up LOIs on deals that are very unlikely to succeed.

While it’s not my place to say that this is a bad strategy, having been on both sides of the table numerous times, I can say with utmost confidence that “low-balling” usually doesn’t lead to a good working relationship. At worst, it can end up killing the chances of a deal before it’s even on the table.

And I do consider an offer of “70% over a 5-year term” to be in the same low-balling category as just offering 30% of the asking price 🙂

In a dynamic market like this, it’s important to build goodwill with the seller (and the broker) from day #1. And a big part of this is being respectful and trying to avoid putting forward offers that are unlikely to fly or downright offending. It’s worth remembering that it’s often the seller who gets to choose whom to sell to, not the other way around, so nurturing a great relationship is incredibly important.

But is there a place for seller financing at all, then?

Yes, absolutely. I see the seller-financing component added to deals all the time, but usually at a reasonable level (think 10-15% of the purchase price) and only where it makes sense. It’s common to have a 10% seller note in place for a $2MM deal that is SBA-financed and requires a lengthy transition period. But offer one on a $250,000 straightforward ecommerce business, and you’re guaranteed to get a couple of weird looks from the broker, followed by a resounding “no.”