How to Buy a Profitable Web Business for $100k or Less

The two most common questions people ask from me are “how should I go about buying a website for <$100,000?” and “Can I find a decent online business for less than 2x its yearly profit?”. These questions are often asked by the same people.

The answers to them are more complicated than one might think, and if you were to ask 10 people somewhat familiar with the online acquisitions industry then odds are that you’d hear answers ranging from “It’s impossible” to “Easy. Just browse Flippa” – both of which are colossally wrong.

Seller’s Market

Let’s first break a few myths.

The times where high quality (more on this later) web businesses were bought and sold for less than a year’s worth of net revenue are long gone.

Whether we like it or not, we’re very much in a seller’s market, and the number of willing buyers with cash on hand far exceeds the number of good businesses available, putting you as a buyer in a serious disadvantage.

What makes things worse is that even though myself and any other person who’s involved in this industry in professional capacity would tell you the above, it’s not as obvious as it could or should be.

One can easily log on to a site like Flippa.com, BizBuySell, or even eBay and find a large array of websites listed for sale at super low profit multiples – often lower than 1x yearly net profit – that are waiting to be picked up for a wise investment decision.

But is that really the case?

Scams, Frauds and Lemons

Scammers have been active in our industry ever since it started emerging about a decade ago, and over the years they’ve only gotten smarter, making it more and more important for buyers to be increasingly cautious and leave no stone unturned.

But for the sake of this article I’m going to assume that you’re relatively educated when it comes to spotting scam attempts, and it wouldn’t be easy to have you hand over a large amount of cash in exchange for a complete dud.

Which brings me to low shelf-life lemons (for the lack of a better term – pardon my twisted sense of humour).

Low shelf-life lemons are the kind of fruit variety that tends to rot very quickly after picking. As such, even though it’s typically still fresh and absolutely edible at the time of purchase, you can be sure that by the time you get home it’s already half-rotten.

Unfortunately, this kind of websites have become extremely common, and are mostly the reason why one might mistakenly think that the average price multiple is fairly low across the board.

What makes these sites extremely dangerous when compared to downright scams is that while scam and fraud can be fairly easily identified, this kind of businesses are typically 100% legitimate – just not sustainable in the long run.

I will leave specific examples and counter-measures for another day (do let me know in comments below if you’re interested), but in general these sites range from ones that are built around unsustainable traffic sources, to sites that provide little to no value or are built around a ‘loophole’, to ones that promise passive income but are in reality an 80 hours a week job.

With this in mind, it’s more important than ever to not only perform “fact based due diligence” that deals with verifying key metrics, but also put some serious analytical thought into the overall business model and core building blocks of each acquisition opportunity to determine the likelihood that the business fails shortly after its purchased.

Obtaining an Edge

By now we’ve established that quality properties are far and between, and that you can most certainly not expect to pick one up for a bargain unless there’s something wrong with it.

But this certainly doesn’t mean that it’s impossible to get good deals as a buyer – you just need to get a little bit creative and go a few steps further than opening up Flippa (or signing up to a broker’s mailing list) and expecting the goodies to be handed to you on a silver platter.

I can’t do the hard work for you, but I can give you a few potential strategies, some of which I employ myself when I buy sites, in hopes that some of them will be useful to you as well:

Strategy #1 – Adjust your price range

If your per-acquisition budget is between $20,000 and $100,000 then you’re facing the worst possible competition in the industry. Decent sites in this price range tend to sell in a matter of days and often for multiples exceeding 3.5x yearly net profit.

Since adjusting down is not overly feasible due to the average low quality of smaller sites (see Why one $200k Website is a Better Acquisition than ten $20k ones for more on this), you should seriously consider adjusting up and going after slightly bigger properties.

I’m of course not suggesting you to increase your overall spend, but in most cases the above can be achieved through purchasing fewer properties than initially planned or involving partners/investors.

Strategy #2 – Adjust your target multiple

Understand and accept that the days of 1x multiples are long gone, and in other to pick up a decent business you need to either pay a decent multiple or get very lucky.

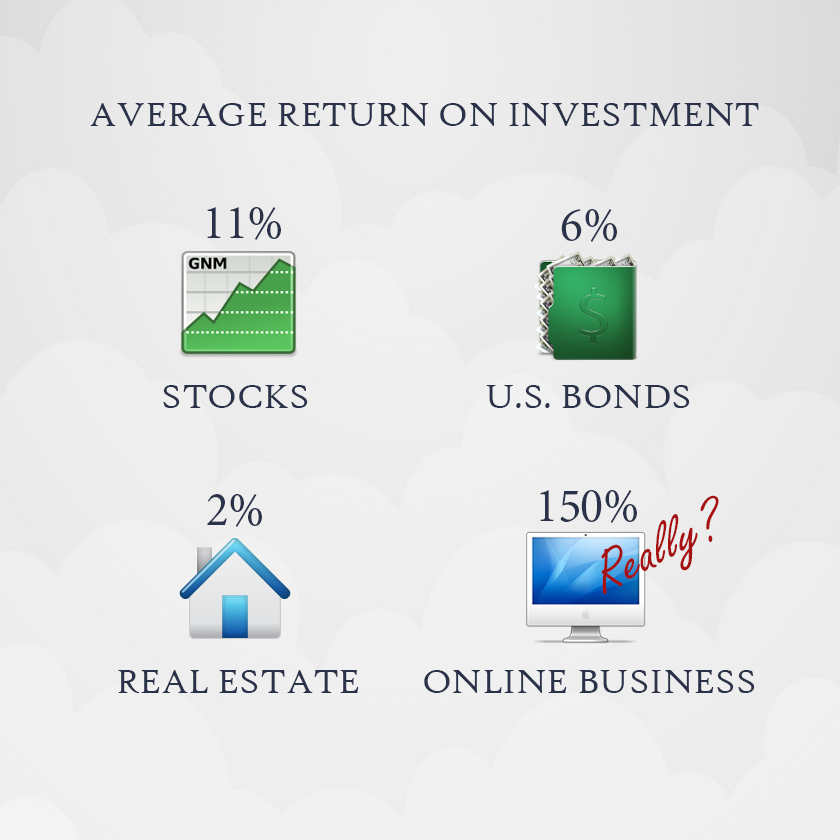

With this in mind, many would argue that a multiple of 3.5x yearly net profit is still a very good deal, when compared to nearly any ‘traditional’ investment opportunity. This is especially true when it’s coupled with a good and well thought-through development plan that will ensure the immediate growth of the asset acquired.

Take your time to plan out your growth strategy and model your ROI accordingly, rather than expecting to pick up ‘passive’ assets and have them retain the status quo – something that rarely happens.

Strategy #3 – Seek opportunities through unconventional channels

It doesn’t take a genius to browse through listings on Flippa.com or put your name down with 3 or 6 of the biggest brokers to have new listings delivered to your inbox on an ongoing basis.

Because of this, Flippa has hundreds of thousands of users and most brokers have buyer lists in the tens of thousands, making you one of a large number of people that gets access to the same inventory.

One way to obtain a significant edge is applying some ‘out of the box thinking’ (pardon the cliché) and instead of going through conventional channels, find and reach out to web business owners yourself, putting you far ahead of competition.

This is much easier said than done and I know very few people who can successfully pull off direct prospecting on an ongoing basis, but speaking from experience it’s certainly not impossible, and with enough effort it can be very rewarding.

Bottom Line

There’s no shortage of “industry experts” who are quick to tell you that the hay days of website acquisitions are over and there’s no money to be made any longer, as well as ones who keep playing their broken record about 1 year multiples.

Unfortunately, few of these people have any actual experience in investing in web properties, and those who do haven’t done any transactions in a long time, making them uninformed of what’s been happening in the industry.

In reality, profiting from buying web assets is as feasible as ever, but does require some intelligence and strategising – similarly to any other investment.

Please let me know in the comments below if you agree or disagree, and whether you have anything to add!