Experts’ Guide to Website Due Diligence – Part 1

In this series of articles, I’ll be covering the whole process of website due diligence, from start to finish. The guide is intended to prove a useful resource for those about to purchase a website or an online business, to make sure you won’t get scammed out of your money or buying a business that carries a significant risk of failure or loss of revenue.

In Part 1 of this guide, we’ll look at website due diligence in general, what it consists of, how the process works, and how it differs from business model to business model.

Online Business Due Diligence – What, Why and When?

Due diligence is a critical part of any business acquisition – online or offline, and regardless of whether you’re buying a $3,000 AdSense website or a $2 Million established ecommerce operation.

The process can be split into two distinct categories:

Risk Analysis – helping you determine whether the business that you’re about to buy is likely to remain strong, rather than fail or go into a deep decline shortly after the purchase.

Verification – making sure that what’s claimed is really true, and that you’re not dealing with a scammer who’s faked the site’s revenue or traffic numbers and is trying to take you for a ride.

While due diligence, particularly online business due diligence, is a very complex subject, it’s no rocket science and there’s no reason to fear it.

It’s true that some parts of it do need a trained eye to spot inconsistencies and red flags, but the good news is that the majority of what it takes is easy and straightforward, and can be undertaken by nearly anyone with a general understanding of business and the online world.

Who’s Responsible for Due Diligence?

Due diligence is always the sole responsibility of the buyer.

There are some brokers out there who like to claim that they’ve “completed all or part of due diligence on the buyer’s behalf”. These claims should never be taken seriously.

Always keep in mind that the broker works for the seller. In most cases, the broker (or an online marketplace platform) only gets paid when they successfully sell the business, making them a biased, impartial party whose word should never be given any value when it comes to “vouching” for the sites that they sell.

This isn’t to say that good brokers don’t perform due diligence on the sites that they list. They do, and it’s great that they do. One familiar with the industry is surely aware that some brokers tend to list good, high-quality properties, whilst others appear to have an “anything flies” policy.

But broker-side due diligence serves the sole purpose of keeping the overall quality of listings high, and making sure that no deals fall through at the 11th hour. It’s also rarely very thorough, making buyer-side due diligence still extremely important.

When’s the Right Time for Due Diligence

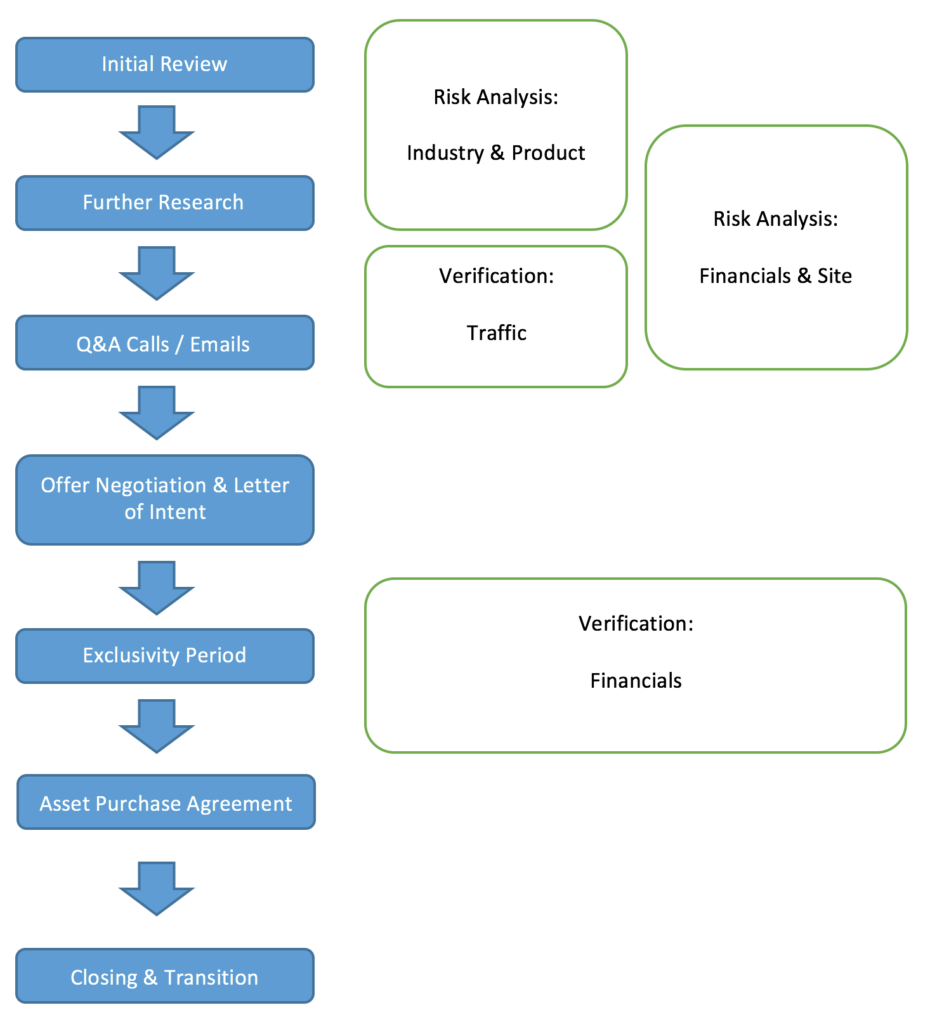

Due diligence shouldn’t be viewed as a separate ‘phase’ in the acquisition process, but rather something that’s ongoing from the moment you first begin reviewing the opportunity, until the late stages of verification and contract negotiation.

A typical ‘deal time line’ looks something like this:

As you can see in the image above, different parts of the due diligence process run in parallel with the rest throughout nearly the whole timeline of the transaction.

Some would try to argue that it would be much easier to just “get done with it” in one go, but there are some good reasons why this isn’t usually advisable, or even possible.

Time Expense

Since unfortunately a large percentage of acquisition opportunities out there are either built on overly risky or unsustainable business models, or are downright fraudulent, many fail the due diligence process quite easily.

With this in mind, it would be unfeasible to prepare the whole process and request mountains of documentation and verification from the seller, just to have the site “fail” your due diligence in the early stages.

Instead, you can adopt the “lean approach”, and run the analyses that the site is most likely to “fail” in first, eliminating the need to spend more time on other aspects should any deal breakers surface already early on.

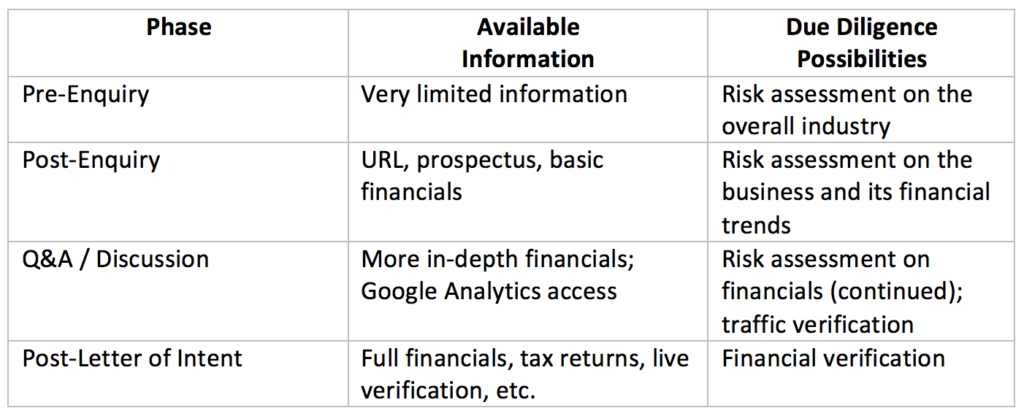

Availability of Information

In a traditional online business purchase transaction, the information that you as the buyer will have at your disposal increases throughout the process, allowing you access to more data that you can investigate as you move on.

It usually works along these lines:

Setting Expectations

Even though due diligence doesn’t have to be overly complicated or time consuming if done right, it’s nearly always an intrusive process that isn’t fully enjoyable – mostly for the seller.

Because of this it’s important to set the expectations already from Day 1, and make sure that the seller is on the same page with your requirements.

The reason why most people fear due diligence is that they don’t know what to expect. For this reason, I always tend to compile my due diligence checklist early on for each acquisition, and send it to the seller as early as possible, both to make them feel more comfortable with the process, but also to allow them sufficient time to gather the information and documentation that I’ll be asking for.

Part 2 of this guide will be published shortly and will include my own due diligence checklist templates, with some instructions on how to use them and make them suitable for nearly every acquisition.

If you want to get a quick email alert when Part 2 is out then just pop your name and email into the “Sign up for Updates” box on the left-hand side and I’ll let you know the moment it’s available!